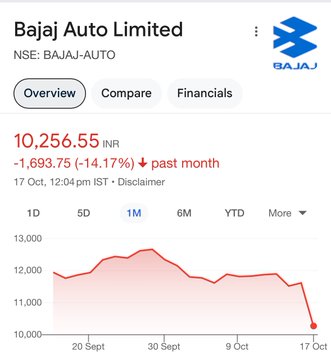

Bajaj Auto share price has experienced a steep decline, falling over 10% following the announcement of its second-quarter (Q2) financial results for FY2024-25. The disappointing sales outlook for the festive season has raised concerns across the automotive sector. This article delves into the details surrounding Bajaj Auto’s performance, its implications on other automakers, and the broader market sentiment.

Key Takeaways

- Significant Decline in Share Price: Bajaj Auto shares fell as much as 12% during intraday trading, marking the steepest drop since March 2020.

- Subdued Festive Demand Outlook: The company projected a growth of only 3% to 5% for the festive season, which is significantly below the industry expectation of 8%.

- Impact on Competitors: Major competitors, including Hero MotoCorp and TVS Motor, also saw their stock prices decline by approximately 4.5% each.

- Wider Market Impact: The Nifty Auto index plummeted 3.5%, reaching its lowest point since mid-August 2024.

Recent Developments

Bajaj Auto Q2 Results:

- Consolidated Profit Decline: Bajaj Auto reported a 31% year-on-year (YoY) decline in consolidated profit after tax, amounting to ₹1,385 crore. The decrease was attributed to increased expenses and adjustments in deferred tax provisions.

- Revenue Growth: Despite the profit decline, total revenue from operations rose to ₹13,247 crore, compared to ₹10,838 crore in the same period last year. This indicates that while revenue increased, profitability was hindered.

| Specification | Q2FY25 | Q2FY24 |

|---|---|---|

| Net Profit | ₹1,385 crore | ₹2,002 crore |

| Total Revenue | ₹13,247 crore | ₹10,838 crore |

| EBITDA | ₹2,652.4 crore | ₹2,122 crore |

| EBITDA Margin | 20.2% | 19.8% |

| Yearly Share Price Decline | 10% | – |

Factors Behind the Decline

- Weak Sales Forecast: Rakesh Sharma, Executive Director of Bajaj Auto, indicated that motorcycle sales during the festive season are expected to grow only by 1% to 2%. This projection falls well below the market’s expectations, causing significant concern among investors.

- Consumer Behavior: Rising inflation and increasing food prices have impacted consumer spending power. Retailers reported a trend of consumers scaling back on expensive purchases, especially in the two-wheeler segment.

- Market Sentiment: As the first major player to announce Q2 results, Bajaj Auto’s cautious outlook set a negative tone for the automotive sector. Analysts had anticipated a rebound in sales during the festive season, which did not materialize.

- Competitive Landscape: Other two-wheeler manufacturers, such as Hero MotoCorp and TVS Motor, are also experiencing similar declines due to the cautious sentiment surrounding the industry.

Analyst Reactions

Following Bajaj Auto’s results, several brokerage firms have revised their ratings on the stock:

- Emkay Global: Downgraded Bajaj Auto to a ‘sell’ from ‘reduce,’ adjusting the target price to ₹9,500 per share, indicating a potential downside of over 18% from its previous closing price.

- Citi: Issued a ‘sell’ rating with a target price of ₹7,800 per share, projecting a downside of more than 32%. The firm cited marginal misses in average selling price (ASP) and gross margins as key concerns.

- Kotak Institutional Equities: Expressed that the domestic two-wheeler industry could face downside risks if demand does not pick up during the Diwali festival.

Broader Market Impact

The decline in Bajaj Auto’s share price has also affected the Nifty Auto index, which fell 3.5% during intraday trading. The index hit 25,004 points, marking a substantial loss of 7% for October so far, the steepest monthly decline since February 2022.

Challenges for Passenger Vehicle Manufacturers

- Sales Decline: The passenger vehicle segment is experiencing significant challenges, with sales declining for three consecutive months. The Society of Indian Automobile Manufacturers (SIAM) reported a cumulative 1.8% year-on-year drop in sales to dealers for the September quarter.

- SUV Market Slump: The SUV segment, a key growth driver, witnessed a decline of 9% in the September quarter compared to a growth of 23.5% in the previous year.

- High Inventory Levels: Automakers face high inventory levels due to weak demand trends. Kotak Institutional Equities anticipates a 1% decline in domestic passenger vehicle wholesale volumes for FY2025.

Conclusion

The recent plunge in Bajaj Auto’s share price underscores the challenges faced by the automotive sector in India. Despite recording revenue growth, the company’s weak outlook for festive season sales has sent shockwaves through the market, affecting not just its stock but also that of its competitors. Investors are advised to approach the situation cautiously, considering the potential risks and uncertainties in consumer demand, particularly in the context of rising inflation and changing consumer behavior.

As the festive season progresses, all eyes will be on whether the anticipated sales boost materializes or if the automotive sector will continue to face headwinds. The coming weeks will be critical in determining the future trajectory of Bajaj Auto and the broader automotive industry in India.