The Indian stock market witnessed a flurry of activity on October 17, 2024, as a host of companies, including Infosys, Wipro, Axis Bank, and LTIMindtree, announced their Q2 earnings. This article delves into the significant outcomes from these announcements, focusing primarily on Infosys, which has become a bellwether for the IT sector.

Earnings Summary

Major Companies Reporting on October 17

| Company | Net Profit (Q2 FY25) | Revenue (Q2 FY25) | YoY Change in Profit | YoY Change in Revenue | Remarks |

|---|---|---|---|---|---|

| Infosys | ₹6,506 crore | ₹40,986 crore | +4.7% | +5% | Guidance raised to 3.75%-4.5% |

| Wipro | ₹3,208.8 crore | ₹22,301.6 crore | +21.2% | -0.95% | Declared 1:1 bonus shares |

| Axis Bank | ₹6,918 crore | ₹37,142 crore | +18% | +17.1% | Strong growth in NII |

| LTIMindtree | ₹1,251 crore | ₹9,432.9 crore | +7.7% | +6% | Steady growth in revenue |

| Polycab India | ₹445.2 crore | N/A | +3.6% | N/A | Healthy profit increase |

| Tata Communications | ₹227.2 crore | ₹5,767 crore | +3% | +18.4% | Strong revenue growth |

| Tata Chemicals | ₹267 crore | ₹3,999 crore | -46.1% | Flat | Significant decline in profit |

Infosys Q2 Financial Highlights

Infosys, India’s second-largest IT services exporter, reported its Q2 earnings with mixed results that raised some eyebrows in the market.

- Net Profit: Increased to ₹6,506 crore, a 2.2% rise from the previous quarter but below market expectations, which estimated profits at ₹6,769 crore.

- Revenue: The company reported ₹40,986 crore, up 4.2% from the previous quarter. This was in line with forecasts but indicates a need for caution among investors.

- Earnings Before Interest and Tax (EBIT): Recorded at ₹8,649 crore, up 4.4% sequentially.

- EBIT Margin: Steady at 21.1%, indicating stability in operations.

Growth Guidance

Despite missing profit estimates, Infosys revised its FY25 revenue growth guidance upward to 3.75%-4.5%, improving from the previous range of 3%-4%. This increase is attributed to a strong ramp-up of mega deals and positive demand from financial services.

Key Metrics

| Metric | Q2 FY25 |

|---|---|

| Net Profit | ₹6,506 crore |

| Revenue | ₹40,986 crore |

| EBIT | ₹8,649 crore |

| EBIT Margin | 21.1% |

| Dividend | ₹21 per share |

| Record Date for Dividend | October 29, 2024 |

| Payout Date for Dividend | November 8, 2024 |

| Voluntary Attrition | 12.9% |

Market Reaction

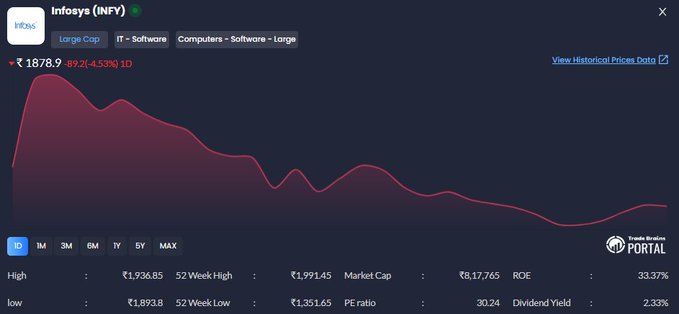

Following the announcement, Infosys shares fell by 5%, closing at ₹1,869. This reaction can be attributed to:

- Lower-than-expected net profit: The disappointing figures did not sit well with investors.

- Cautious outlook on discretionary spending: Infosys highlighted challenges outside the US banking sector, indicating a slower recovery in spending.

- Delayed wage hikes: The postponement of wage increases raised concerns about employee morale and retention.

Other Notable Earnings

Wipro

Wipro reported a consolidated net profit of ₹3,208.8 crore, marking a 21.2% increase from the previous year, although revenue declined by 0.95%. The company also announced a 1:1 bonus share, which will attract investor interest.

Axis Bank

Axis Bank achieved an 18% increase in net profit, reaching ₹6,918 crore, supported by a robust 10% growth in net interest income (NII). This strong performance showcases the bank’s effective risk management and customer acquisition strategies.

LTIMindtree

LTIMindtree reported a 7.7% increase in net profit to ₹1,251 crore, with revenue climbing to ₹9,432.9 crore, reflecting a steady recovery in demand.

Polycab India

Polycab India saw a 3.6% increase in net profit to ₹445.2 crore, continuing its positive trajectory amidst competitive market conditions.

Tata Communications

Tata Communications reported a 3% rise in net profit to ₹227.2 crore, with revenue surging by 18.4%, indicating strong operational performance.

Tata Chemicals

Tata Chemicals, however, experienced a sharp 46.1% decline in net profit to ₹267 crore, reflecting market challenges despite flat revenue.

Conclusion

The mixed results from major players like Infosys, Wipro, and Axis Bank underscore the complexities of the current economic landscape. While Infosys raised its revenue guidance and remains optimistic about future growth, its lower-than-expected profit led to a sell-off in shares, reflecting the cautious sentiment in the market. Investors should closely monitor upcoming earnings and market conditions to gauge potential investment opportunities.

Future Outlook

With a total of 36 companies declaring earnings on the same day, including prominent names across various sectors, the coming days will be crucial for investors and market watchers. The performance of IT and banking sectors, especially, will set the tone for broader market trends in the remainder of FY25.