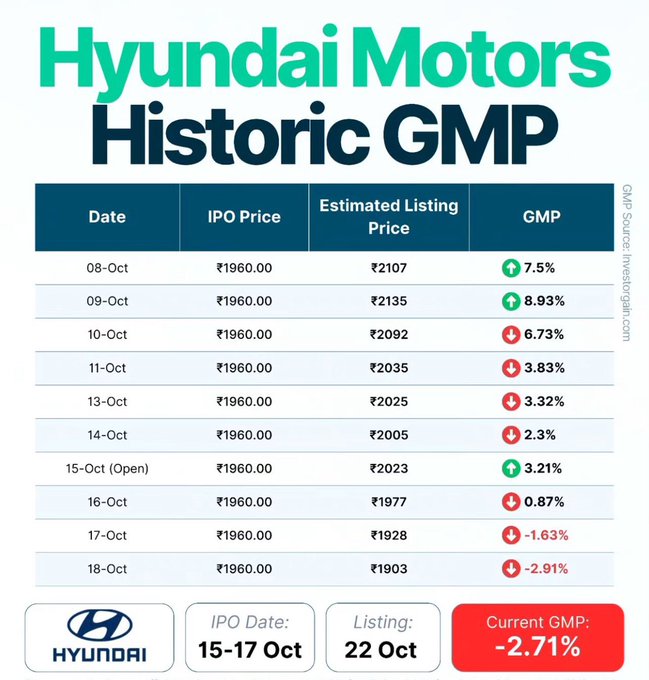

Hyundai IPO date is October 22, with a mixed response and a subscription rate of 2.37 times. Investors should weigh risks and long-term growth potential. Despite the excitement surrounding this major listing, various signals indicate that investors should approach with caution. Here’s an in-depth look at the Hyundai IPO, including its key details, market performance, and what investors can expect moving forward.

Key Details of the Hyundai IPO

- IPO Opening Date: October 15, 2024

- IPO Closing Date: October 17, 2024

- Listing Date: October 22, 2024

- IPO Price Band: ₹1,960 per share

- Total Issue Size: ₹27,870 crore

- Subscription Rate: 2.37 times

- Qualified Institutional Buyers (QIB): 6.97 times

- Retail Investors: 50%

- Non-Institutional Investors: 60%

- Grey Market Premium (GMP): Currently at ₹-33 (indicating a discount)

The IPO Journey

- Initial Response:

- The IPO received a mixed response, particularly from retail investors who only subscribed to 50% of their allocated shares.

- Qualified Institutional Buyers stepped in, helping boost the overall subscription rate to 2.37 times.

- Market Conditions:

- The IPO was launched amid a volatile market environment, with broader market conditions impacting sentiment.

- The automotive sector, in particular, has faced challenges, leading to a cautious approach among investors.

- Investor Sentiment:

- While institutional investors showed strong interest, retail investors remained hesitant, raising concerns about short-term performance.

- The subdued response from retail investors reflects apprehensions about the current market dynamics and Hyundai’s competitive positioning.

Analysts’ Perspectives

Market analysts have expressed varied opinions on Hyundai’s IPO and its potential listing performance. Here’s a summary of their insights:

- Concerns about EV Transition:

- Hyundai’s limited presence in electric vehicles (EVs) is viewed as a significant drawback. Only 11% of its product portfolio consists of EVs and hybrids, compared to competitors who are more agile in this transition.

- Operational Challenges:

- Analysts point to Hyundai’s operational hurdles, including restricted production capacity and a lack of new model launches, which may hinder its growth prospects.

- Historical Performance Trends:

- Historical data from previous IPOs, such as Paytm and LIC, indicate that major IPOs often struggle with initial listings, especially when facing high share float and regulatory constraints.

- Long-Term Outlook:

- Some brokerages, like Nuvama Wealth Management and ICICI Direct, see long-term potential in Hyundai’s solid market position and growth plans. They emphasize Hyundai’s commitment to capacity expansion and localization as key factors that could enhance profitability.

Long-Term Investment Potential

For investors considering a longer-term strategy, several factors support a positive outlook for Hyundai:

- Market Share:

- Hyundai commands a 15% share in India’s passenger vehicle market, making it a significant player.

- In the utility vehicle (UV) segment, Hyundai boasts an impressive 63% share, outperforming industry averages.

- Product Portfolio:

- With over 40 models globally, Hyundai has a roadmap for product expansion in India, where it currently offers 13 models.

- Upcoming launches, including the Creta EV, signal a strategic shift towards electric mobility.

- Production Capacity Expansion:

- Hyundai plans to increase its production capacity significantly. The acquisition of General Motors’ Talegaon plant will add 0.17 million units by FY26 and an additional 0.08 million units by FY28, bringing the total to 1.07 million units.

- Strong Financial Metrics:

- Hyundai’s return on invested capital (RoIC) stands at an impressive 177% for FY24, well above Maruti Suzuki’s 71%. This reflects efficient manufacturing operations, contributing to a robust net asset turnover ratio of 10x.

Potential for Surprising Listing Performance

Despite the current negative GMP indicating a potential discount on listing day, it’s important to recognize that GMP does not always accurately predict market performance. Here are a few reasons why Hyundai could surprise investors:

- Established Brand Reputation:

- Hyundai is a well-known and trusted brand in the Indian market, which could lead to positive investor sentiment despite initial concerns.

- Growth Strategy Execution:

- If Hyundai successfully implements its growth strategies, including EV launches and production capacity expansions, it may achieve sustained long-term growth.

- Market Recovery:

- A potential recovery in the automotive market could improve investor sentiment, especially if Hyundai capitalizes on emerging opportunities in the EV segment.

Conclusion

The Hyundai IPO, with its scheduled listing on October 22, presents both challenges and opportunities for investors. While the initial response has been mixed, with a noted discount in the grey market, the long-term prospects remain promising due to Hyundai’s market position, robust growth strategies, and plans for product expansion.

Investors should carefully weigh the short-term uncertainties against the potential for long-term gains. As always, consulting with financial advisors and conducting thorough research will be essential in navigating this IPO landscape.

For those ready to invest, Hyundai Motor India’s journey on the stock market could be worth watching closely.